Proudly Canadian Start-up

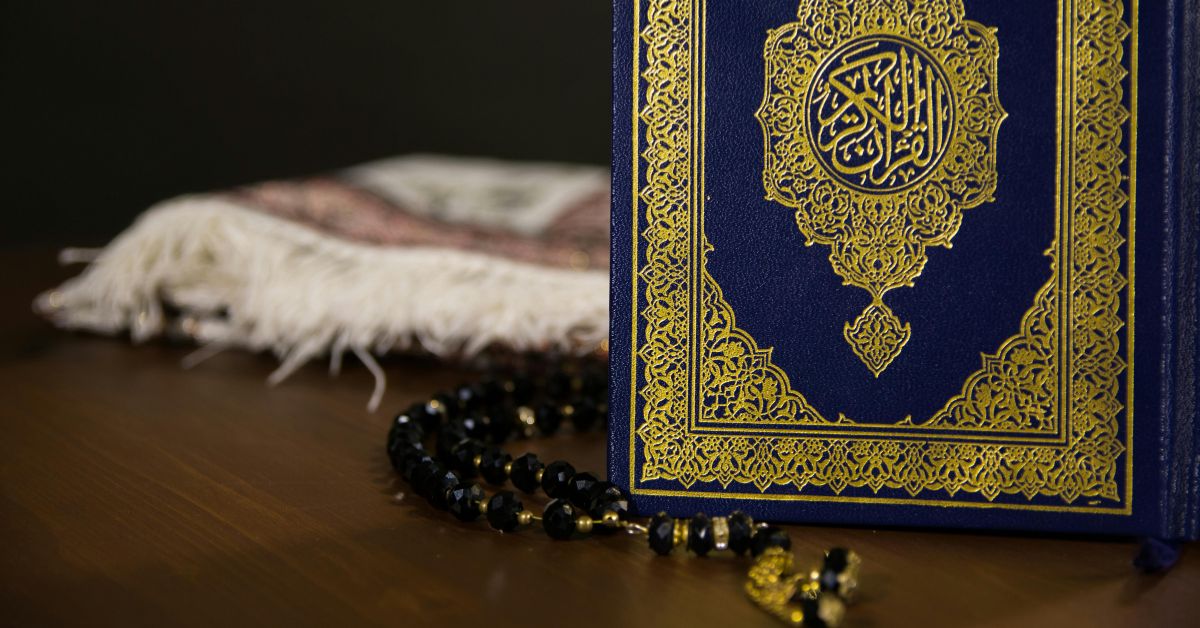

GetTakaful Is Your Trusted Path to Ethical & Shariah-compliant Insurance Solutions

By leveraging Blockchain, decentralization, and smart contracts, GetTakaful enhances transparency, minimizes costs, and provides more ethical, flexible, and customizable coverage options, ensuring a seamless and fair insurance experience.

The insurance services we offer

We provide tailored insurance solutions designed for transparency, affordability to meet your need

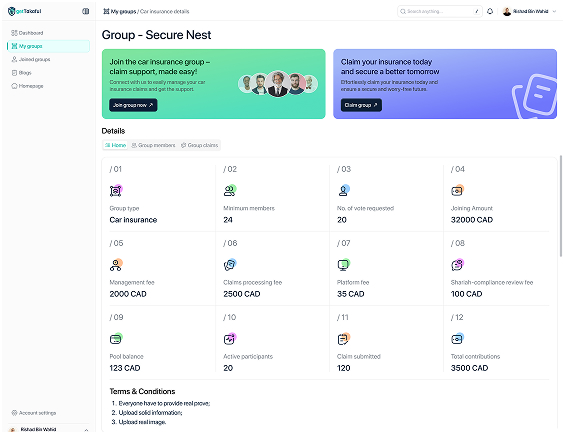

GetTakaful started with auto insurance in Canada. Create a pool or join one for fair and affordable coverage.

Ensure your family’s financial security with flexible and ethical coverage. Join or create a pool for peace of mind

Protect your property with fair and transparent coverage. Create or join a pool for secure and cost-effective protection

Protect your business with transparent and cost-effective coverage. Create or join a pool for tailored protection.

How GetTakaful Works

At GetTakaful, we redefine insurance with a Shariah-compliant, ethical Takaful model based on cooperation and mutual protection.

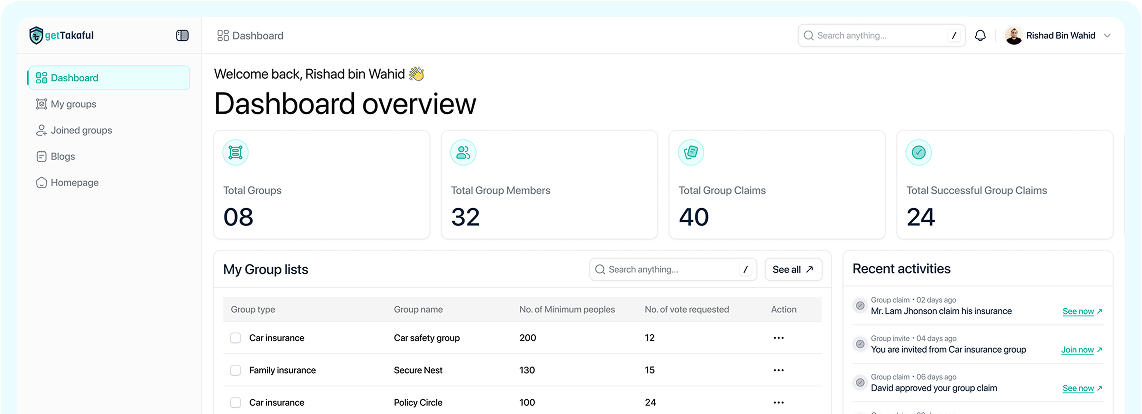

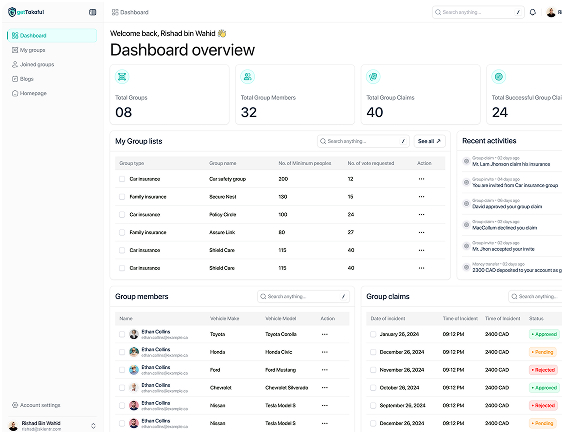

Experience the convenience of managing all your tasks, operations, and projects from a single, unified platform. Say goodbye to scattered tools and disorganized workflows. With everything in one place, you can streamline processes, enhance team collaboration, and boost overall productivity—all while saving time and reducing complexity.

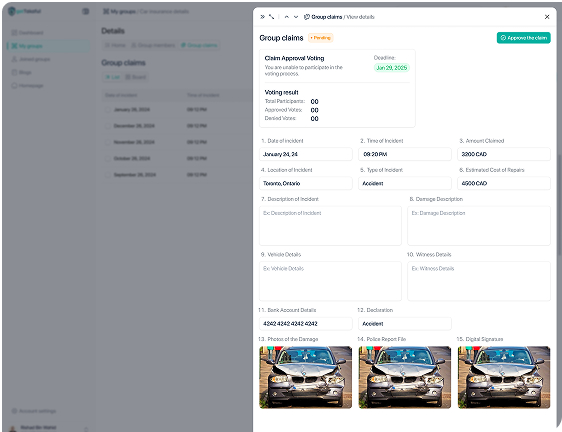

As a participant, you become part of a community of members who pool their contributions for mutual assistance. Instead of paying premiums to a traditional insurer, your contributions are collected into a shared fund that provides support when any member needs to make a claim.

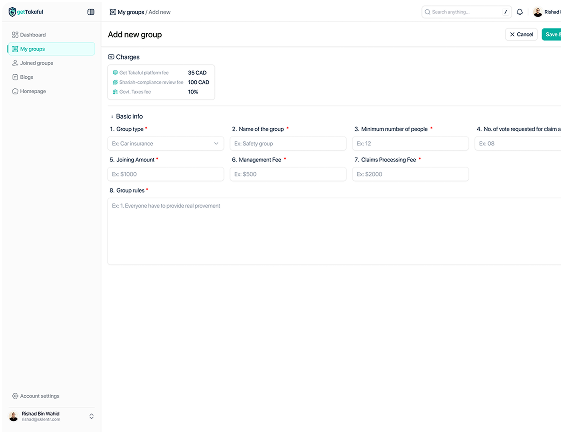

Claim the group and take the reins by leading with confidence and vision. By asserting ownership, you create a strong foundation for collaboration and growth, empowering your team to work towards common goals. With your leadership, the group will thrive, achieve new milestones, and unlock its full potential.

Expand your network and create new opportunities by adding a new group. Whether it’s for collaboration, communication, or project management, building a fresh group helps you organize efforts, foster teamwork, and drive success with a unified focus.

Explore our goal, mission, and vision to understand our purpose and direction. Learn how our values and objectives drive us forward, shaping a future of growth and impact

At GetTakaful, we are on a mission to provide insurance coverage that aligns with your values and beliefs. We understand the importance of financial protection for individuals and families, and that’s why we offer an ethical and Shariah-compliant insurance solution.

Join GetTakaful for ethical coverage, financial security, and community support—protection with purpose!

Our Shariah-compliant Takaful model ensures fairness and transparency, pooling contributions for members’ benefit and sharing any surplus within the community.

GetTakaful operates without interest or unethical investments, ensuring all funds are managed in a Shariah-compliant manner and invested in halal industries.

Unlike conventional insurance where risk is transferred to the company, in Takaful, members share the risk. You are protected by your community, & you help protect others.

GetTakaful is built on a foundation of mutual support, where members help one another in times of need, creating a united and secure community for all.

GetTakaful shares regular articles to help you stay informed and gain a deeper understanding of our services and values

Insurance is one of the most important financial tools for protecting yourself, your family, and your

If you’re exploring insurance options in Canada, you may have come across the term “takaful insurance”

Takaful offers an alternative to conventional insurance. But when a loss occurs, how does the claims